Definition of the Deposit Insurance Corporation and Financial Services Authority

Definition of the Deposit Insurance Corporation, the Duties of the Deposit Insurance Corporation, the Authority of the Deposit Insurance Corporation

Deposit Insurance Corporation

Definition of Deposit Insurance Corporation

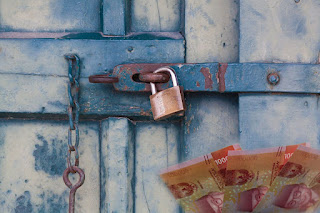

Why do people believe that the funds they deposit in bank accounts are safe? It will not be lost and when it is needed it will be available according to the amount stored. Feeling trust in banks and feeling safe because there are institutions that guarantee their deposits are part of the main reasons why people keep their funds in banks.

Who guarantees people's deposits in the bank? Did you know?

According to Law Number 24 of 2004 concerning IDIC, IDIC is an independent, transparent, and accountable institution with two main functions, namely guaranteeing depositors' deposits and actively participating in maintaining the stability of the banking system in accordance with its authority.

Duties of the Deposit Insurance Corporation (LPS)

In order to carry out its functions, IDIC has the following duties.

- Formulate and establish policies in the implementation of deposit insurance;

- Perform deposit insurance;

- Formulate and establish policies in order to actively participate in maintaining the stability of the banking system;

- Formulate, stipulate, and implement a policy for the settlement of Failing Banks that does not have a systemic impact; and

- carry out the handling of Failing Banks that have a systemic impact.

In your opinion, what is meant by Failed Bank? Try to collect information from relevant sources, including internet media, newspapers and discuss it with your study group, what exactly is a Failing Bank? If referring to Law Number 24 of 2004, what is meant by a failed bank is a bank that is experiencing financial difficulties and endangers its business continuity and is declared unable to be rehabilitated by the Banking Supervisory Agency (LPP) in accordance with its authority.

Based on the description, it is clear that in carrying out its duties, IDIC cannot work alone, it cooperates with LPP. According to Law Number 21 of 2011 concerning OJK, the State institution that regulates and supervises banking is the OJK, so that in carrying out its duties, LPS cooperates with OJK and Bank Indonesia as the monetary authority.

Authority of the Deposit Insurance Corporation (LPS)

How is the division of authority between LPS and other state institutions that have functions such as Bank Indonesia and OJK? The LPS's powers as stipulated by Law Number 24 of 2004 are as follows.

Set and collect insurance premiums.

Determine and collect contributions when the bank first becomes a member.

Manage the assets and liabilities of the IDIC.

Obtain customer deposit data, bank health data, bank financial statements, and bank inspection reports as long as they do not violate bank secrecy.

Perform reconciliation, verification, and/or confirmation of the data.

Determine the terms, procedures, and conditions for payment of claims.

Appoint, authorize, and/or assign other parties to act for the interests of and/or on behalf of IDIC, in order to carry out certain tasks.

Conduct counseling to banks and the public.

Imposing administrative sanctions.

What are the bank products guaranteed by the LPS and how much is the deposit in the bank guaranteed by the LPS? LPS guarantees bank customer deposits in the form of demand deposits, time deposits, certificates of deposit, savings, and/or other equivalent forms. Since October 13, 2008, the guaranteed balance for each customer at one bank is a maximum of Rupiah 2 Billion.

Thus, do not hesitate anymore to save money in the bank, learn from an early age to set aside money to be stored in a bank account so that in the future you can be independent, the cost of buying books, buying shoes, the cost of continuing your studies and so on can you set aside your pocket money by saving it in the bank from now on.

Financial Services Institutions in the Indonesian Economy, the Financial Services Authority and Its Functions

Financial Services Institutions in the Indonesian Economy, the Financial Services Authority and Its Functions

Financial Services Institutions in the Indonesian Economy. Financial service institutions are all entities that through activities in the financial sector withdraw money from the public and channel the money back to the community.

Do you already have savings in the bank?

Savings is a product of raising funds from banks. Apart from being at the bank, in order to meet your financial and investment needs, you can also take advantage of the products of other financial service institutions, such as financial service authorities, capital markets, insurance, pension funds, pawnshops, and financing institutions.

The money you deposit in the bank is guaranteed by the Deposit Insurance Corporation (LPS). The function of LPS according to Law Number 3 of 2008 concerning LPS article 4 is to guarantee deposits of depositors and to actively participate in maintaining the stability of the banking system in accordance with their authority. In this discussion, you will learn about things related to OJK, LJK, capital markets, insurance, pension funds, financing institutions, and pawnshops.

Financial Services Authority

Definition of the Financial Services Authority

According to Law Number 21 of 2011 that OJK is an independent institution and free from interference from other parties, which has the functions, duties, and authorities of regulation, supervision, examination, and investigation as referred to in the OJK Law. The statement explains that the OJK is an independent institution in carrying out its duties and authorities, free from interference from other parties, except for matters that are expressly regulated in the OJK Law.

The existence of the OJK has made the regulation and supervision of financial service activities in the capital market, insurance, pension funds, financial institutions, and other financial service institutions shift from the Capital Market and Financial Institution Supervisory Agency (Bapepam-LK) to the OJK. Financial services in the banking sector were transferred from Bank Indonesia to the OJK. The OJK Institution is an independent institution which, in carrying out its duties and authorities, is free from interference from other parties, except for certain matters regulated in the OJK Law.

Based on this explanation, it can be concluded that OJK is an independent state institution that is authorized to carry out the task of regulating and supervising the financial services industry in Indonesia. The financial institutions that are regulated and supervised are banking, capital markets and the Non-Bank Financial Services Industry (IKNB), which consists of insurance, pension funds, and financing institutions.

Objectives, Roles, Functions, Duties and Authorities of the Financial Services Authority (OJK)

Based on the understanding of OJK that has been explained earlier, in your opinion, what are the functions, duties and powers of OJK? OJK functions to organize an integrated regulatory and supervisory system for all activities in the financial services sector. The objectives of the establishment of OJK are as follows.

- The activities of the financial services sector are carried out regularly, fairly, transparently and accountably;

- Able to realize a financial system that grows sustainably and stably; and

- Able to protect the interests of consumers and society

In order to carry out these functions and objectives, OJK has three main tasks, namely the first task of regulating and supervising financial service activities in the banking sector; second, the task of regulating and supervising financial service activities in the capital market sector; third, the task of regulating and supervising financial service activities in the insurance sector, pension funds, financing institutions, and other financial service institutions.

Specifically related to bank supervision, OJK's duties include the following four matters.

- Regulation and supervision of bank institutions

- Regulation and supervision of bank soundness.

- Regulation and supervision regarding bank prudence.

- Bank check.

Regulation and supervision of institutions, health, prudential aspects, and bank inspections are the scope of micro prudential regulation and supervision which are the duties and authorities of the OJK.

The scope of macroprudential regulation and supervision as explained in the previous article is the duty and authority of Bank Indonesia as the Central Bank of the Republic of Indonesia.

To carry out regulatory and supervisory duties in the banking sector, OJK has the following powers.

The authorities related to the task of regulating and supervising bank institutions include; licensing for the establishment of banks, opening of bank offices, articles of association, work plans, ownership, management and human resources, mergers, consolidations and acquisitions of banks, as well as revocation of bank business licenses; and bank business activities, including sources of funds, provision of funds, hybridization products, and activities in the service sector.

Authorities related to regulatory and supervisory duties regarding bank soundness include; liquidity, profitability, solvency, asset quality, minimum capital adequacy ratio, maximum lending limit, loan to deposit ratio, and bank reserves; bank reports related to bank health and performance; debtor information system; credit testing (credit testing); and bank accounting standards.

The powers relating to the regulation and supervision of prudential aspects of banks include; risk management; bank governance; know-your-customer and anti-money laundering principles; and prevention of terrorism financing and banking crimes.

Authority to conduct bank checks.

Specifically in order to carry out the task of regulating the financial services industry, OJK also has the following powers.

- stipulate implementing regulations of Law Number 21 of 2011 concerning OJK;

- stipulate laws and regulations in the financial services sector;

- stipulate OJK regulations and decisions;

- stipulate regulations regarding supervision in the financial services sector;

- establish policies regarding the implementation of OJK duties;

As for specifically related to the task of supervising the financial services industry, OJK has the authority, namely:

- stipulate operational policies for supervising the FwMap of financial service activities;

- supervising the implementation of supervisory duties carried out by the chief executive;

- carry out supervision, examination, investigation, as well as consumer protection, and other actions against financial service institutions, actors, and/or supporting financial service activities as referred to in the laws and regulations in the financial services sector; and

- stipulate administrative sanctions against parties who violate the laws and regulations in the financial services sector.

OJK's Objectives, Functions and Duties

OJK's Purpose

- So that financial service activities in the financial sector are carried out in an orderly, fair, transparent and accountable manner.

- In order to be able to realize a financial system that grows in a sustainable and stable manner.

- In order to be able to protect the interests of consumers and society.

OJK Functions

Organizing an integrated regulatory and supervisory system for all activities in the financial services sector.

OJK duties

- Financial services activities in the banking sector.

- Financial services activities in the capital market sector.

- Financial service activities in the insurance sector, pension funds, financing institutions, and other financial service institutions.

In carrying out its duties and authorities, OJK coordinates with other authorities, namely Bank Indonesia and the Deposit Insurance Corporation (LPS). In the event of a bank having problems in its health, OJK will provide information to LPS. IDIC can also conduct inspections of the relevant bank. with its functions, duties, and authorities through coordination with OJK. Likewise, if a bank experiences liquidity difficulties or the bank's health deteriorates, OJK informs the bank to Bank Indonesia to take the necessary steps in accordance with its authority.

Comments